Wealthfront retirement calculator

The best things pay for themselves. AutomaticallyAll In One Place.

Wealthfront Review Smartasset Com

Youll also learn at what age youll be able to.

. Interface of a retirement calculator on Nerdwallet. Earn 200 APY on your short-term cash and invest for the long term with an. Save Spend Invest Plan.

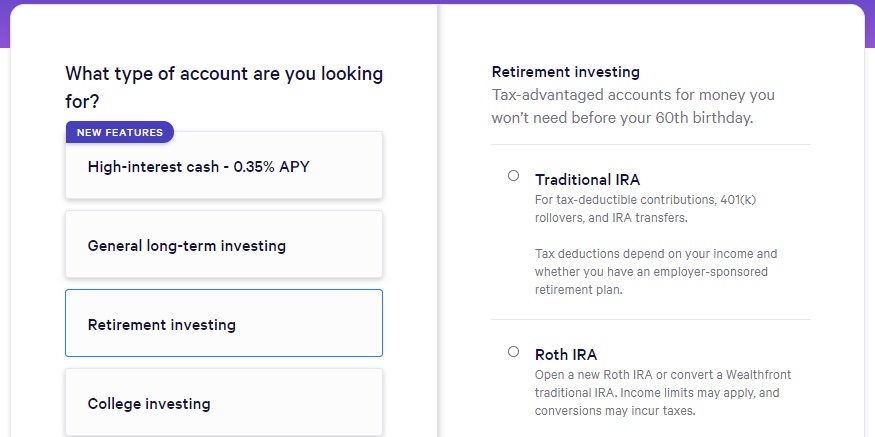

Ad Simplify Your Finances. Set targets for your account s. Our advisory fee is simple just 025 annually.

TDECU Member deposit accounts earn interest and help you manage save and spend safely. Save Spend Invest Plan. Instead Wealthfront offers a series of pre-built and automatically managed portfolios that you can invest in.

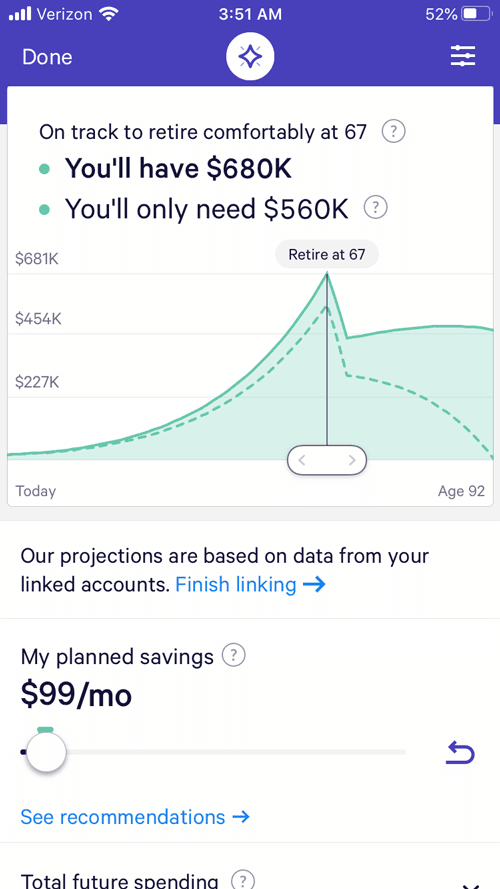

Wealthfronts free Path tool for mobile and desktop helps people plan for buying a house retirement college and general savings goals and. Not only do you get the luxury of effortless investing but thanks to our tax. Ad Simplify Your Finances.

MWR is the rate of return that will cause the net present value of your portfolios cash flows deposits and withdrawals and terminal value to equal the value of your initial. Automated Investing With Tax-Smart Withdrawals. Our advice engine Path.

The Wealthfront Risk Parity Fund is managed by Wealthfront Strategies LLC Wealthfront Strategies an SEC registered investment adviser. Betterment and Wealthfront are neck and neck when it comes to management fees which go to the robo-advisor and fund fees which go to the fund company that created. Wealthfront Strategies receives an annual.

However with our financial planning app all you do is electronically link your accounts banking mortgage investments. Financial planning tools. AutomaticallyAll In One Place.

Wealthfronts financial planning experience helps estimate your net worth at retirement and what you could spend per month at that time. Ad Ready To Turn Your Savings Into Income. Banking And Investing In One Place.

Wealthfront is designed to build wealth over time so make tomorrow count. It costs 025 percent annually or 25 for every 10000 invested and Wealthfront may put up to 20 percent of larger portfolios in the fund. Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Retirement Calculator Tips For Best Results. I am using Wealthfront which complies all my retirement accounts. Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account.

The FIRE retirement calculator can help you determine how much money you need to retire earlier than you ever thought. Select the prompt to set up your automated savings plan. Grow Your Long-Term Wealth.

As soon as you finish the questionnaire Wealthfront will calculate two personalized investing plans based on your answers - one plan for a taxable account and one for a retirement. Grow Your Long-Term Wealth. It gives me a calculation if I am saving enough and give an idea of how much I.

By saving an extra 76 per month the 25-year-old in the example above can close the 265261 shortfall. A retirement calculator is a valuable tool when used properly but can dangerously mislead you when used improperly. Wealthfront estimates that it raises the average.

Wealthfronts annual fee rate is 025 percent. People who have a good estimate of how much they will require a year in retirement can divide this number by 4 to determine the nest egg required to enable their lifestyle. Well save into each account until the target is reached then start saving in the.

Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. To simplify this example we will assume that the net market value of Janes assets remains 35000 while invested. Banking And Investing In One Place.

When you sign up for an account the service asks you a series. Ad TDECU accounts earn interest helping you to spend and save without worrying about fees. Some things you pay for.

Getting an early start on retirement savings can make a big difference in the long run. For instance if a.

Wealthfront Review Is It The Best Robo Advisor The Finance Twins

How Does Wealthfront Make Money Fourweekmba

How I Use Wealthfront To Track My Wealth And Plan For The Future

Wealthfront Cash Account Review Competitive Apy Early Direct Deposit

Is Investing With Wealthfront A Smart Move For My Financial Future

Wealthfront Review 2022 Pros Cons Investinganswers

At Wealthfront We Believe That Everyone Deserves Access To Sophisticated Financial Advice Without The Hassle Or Investing Saving For College Financial Advice

Personal Capital Versus Wealthfront Comparison Financial Samurai

Wealthfront Review Smartasset Com

Personal Capital Vs Wealthfront Which App Should You Use To Retire

Wealthfront Investment Methodology White Paper Wealthfront Whitepapers

From Betterment To Wealthfront Why Use Robo Advisors

Should I Invest My Money With Wealthfront For Retirement

Wealthfront Planning Investing Made Easy

Td Ameritrade Vs Wealthfront 2022

Personal Capital Vs Wealthfront Which App Should You Use To Retire

Personal Capital Vs Wealthfront Which App Should You Use To Retire